Own nothing control everything

Ensure the privacy of your Florida real estate holdings

By keeping your ownership details undisclosed, you minimize the risk of becoming a target.

Do not own real estate in your name

By keeping your ownership details undisclosed, you minimize the risk of becoming a target.

Do not own real estate in your name

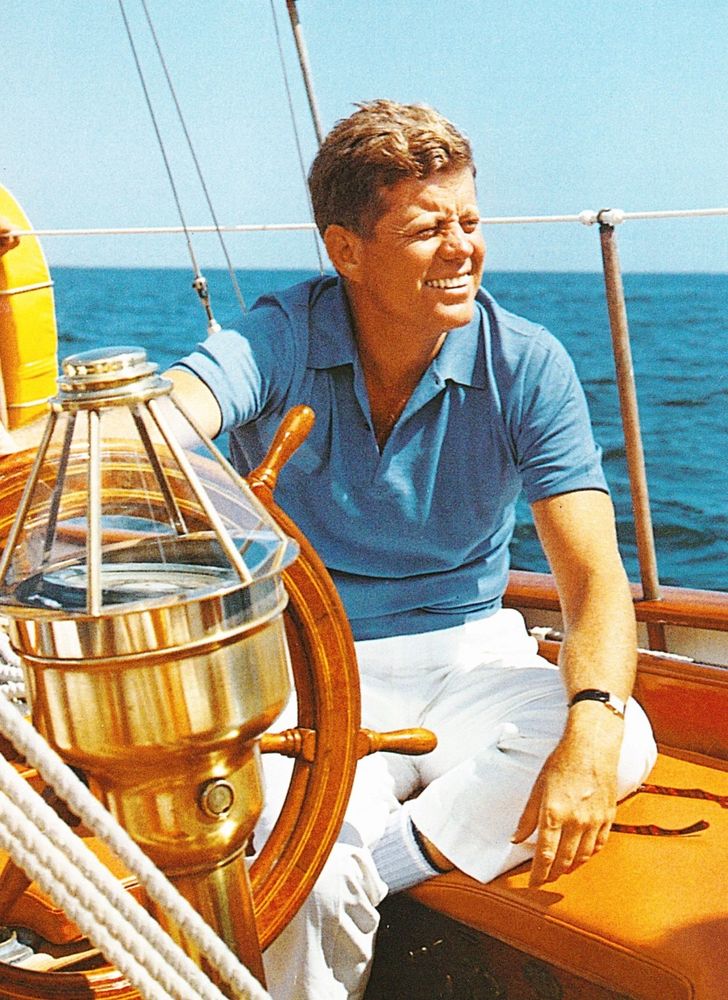

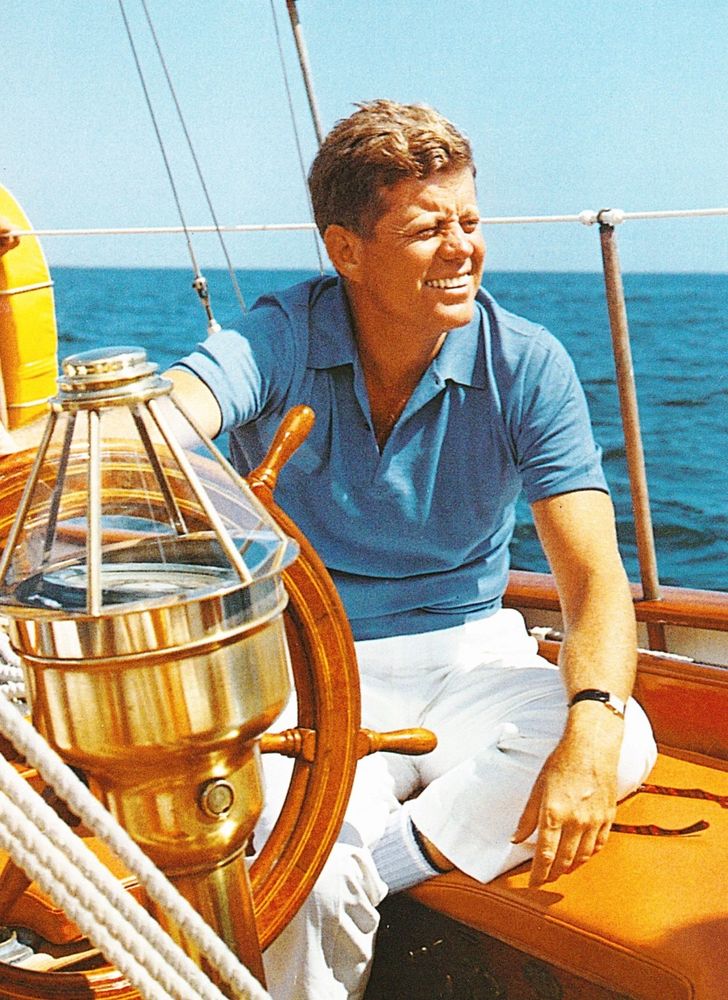

For citizens of Canada and Mexico that are buying real estate in the United states it i s perfectly legal for you to hold title to your real estae via a JFK Land Trust. Please call 850-260-0333.

Becoming an anonymous real estate holder in Florida has many benifits to you:

Florida Statute 689.071 controls land trust agreements and land trust ownership. The statute covers important features of land trust agreements such as trustee powers, trustee liability, and rights of a beneficiary. When a prospective purchaser of real property wants to own the property through a land trust, the first step is to make a written land trust agreement. A land trust agreement should appoint the prospective owner and trustmaker as the beneficiary.

The trustmaker must appoint an independent person as trustee. The trustee may be an individual or legal entity. The purchaser should not name himself as both beneficiary and trustee. The dual appointment may merge the legal and beneficial ownership and collapse the trust. The trustee's name appears on the public ownership records. The trustee has no obligation to pay money towards the purchase or maintenance of the property, and the trustee has no right to benefit from the property. All property benefits

are reserved for the person who is the trustmaker or beneficiary.

The beneficiary has the power to direct the land trust trustee to act on their behalf so that the trust beneficiaries effectively control the property. The land trust trustee is a fiduciary who is legally required to follow the beneficiary's directions. The beneficiaries reserve the right to remove and replace any trustee. Once all parties execute the land trust agreement, the trust can purchase real property. Property is titled in the name of the trustee in his fiduciary capacity, such as "John Doe, Trustee". The "trustee" designation alerts the public that the trustee owns the legal title on behalf of an underlying trust and that other persons hold the beneficial interest in the property. The trustee may be compensated as agreed by the parties and as expressed in the trust agreement.

The beneficiaries contribute money to the land trust, and the trustee uses the money to pay for the property. If the trustmakers are using purchase money financing, the trustmaker may have to guarantee the note, but only the trustee signs the mortgage. The trustee has no personal liability to pay a purchase money mortgage. All income and gain from the property investment is owed to the beneficiaries, less any cost and expense incurred by the trustee.

Unlock the power of privacy with land trusts! Discover how you can safeguard your real estate assets and keep ownership details confidential. Take control of your privacy and minimize the risk of unwanted attention. Reach out to learn more about the benefits of land trusts and how they can protect your interests.

An adverse party that searches the public record will not find properties that someone purchased through a land trust. If the economic owner names a different person or legal entity as the trustee, the trustmaker's beneficial ownership interest in the land trust remains hidden from potential creditors and others interested in the trust maker's assets.

Owners of residential rental property may wish to conceal their ownership from tenants so that the tenants must deal with a property manager instead of bothering the owner. A buyer may want to hide their identity and their other real estate interests during real estate purchase negotiations. Sellers may demand more money if they know a prospective purchaser is wealthy, or that the purchaser is trying to assemble adjoining land for a particular purpose. Walt Disney purchased thousands of acres in land trusts to conceal his plans for Disney World.

Typically, a person can transfer title to real estate only by publicly recorded deed or mortgage. Alternatively, a person may convey their stake in a land trust property by privately assigning, by sale, or by gift, their beneficial interest in a land trust. The public will not be able to discover the transaction and, in the case of a sale, will not know the transfer price or the buyer's name.

A land trust may also avoid the expense of new title insurance if the property is transferred by assignment of trust interests rather than by deed. Land trusts and assignment of beneficial interests may not properly avoid payment of government recording and transfer fees. These issues should be discussed with a real estate attorney or a tax professional.

Real estate owned by an individual must be administered through a probate proceeding after the owner's death. A properly drafted Florida land trust transfers the same property immediately to successor beneficiaries named in a land trust agreement without the need for a probate court proceeding.

A creditor's recorded judgment automatically becomes a lien on all real property titled in the debtor's individual name (except your homestead). A beneficiary's interest in a land trust is personal property, not real property. Therefore, a judgment creditor will not acquire a judgment lien on the property owned in a land trust merely by recording the judgment in the county where the property is located. Florida Statutes provide protection of land trust property from judgments and liens recorded against individual beneficiaries.

When two or more parties want to invest together in real property, they need a written agreement to express their business arrangement. Typically, the investors form a partnership, write a partnership agreement, and file a partnership certificate with the State of Florida. Real estate investors' business arrangements can alternatively be expressed by the terms of a land trust agreement that sets forth the obligations and benefits assigned to different land trust beneficiaries. Limited partnerships must be filed with the State of Florida and must pay significant filing fees. Land trusts are not filed with the state and pay no comparable fees.

The beneficiaries of a Florida land trust can still qualify for the homestead exemption, both for tax purposes and for protection from forced sale by a judgment creditor. A Florida homestead may be owned by a land trust.

It all starts with a conversation. Call us today 850-260-0333.

Experience the JFK Trust difference! Our dedicated team is committed to guiding you towards financial success. Let us tailor an investment strategy specifically for you, aligning with your individual goals and aspirations. Reach out today and embark on your journey to financial empowerment with JFK Trust.

PayPal offers secure payments. Your financial details remain encrypted, ensuring protection. With buyer protection and dispute resolution, PayPal simplifies transactions. Choose PayPal for convenient, worry-free payments worldwide.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.